All Categories

Featured

Table of Contents

The technique has its very own advantages, yet it additionally has issues with high costs, complexity, and extra, causing it being considered a rip-off by some. Boundless banking is not the finest policy if you need only the investment component. The limitless financial concept revolves around the use of entire life insurance policy policies as a monetary tool.

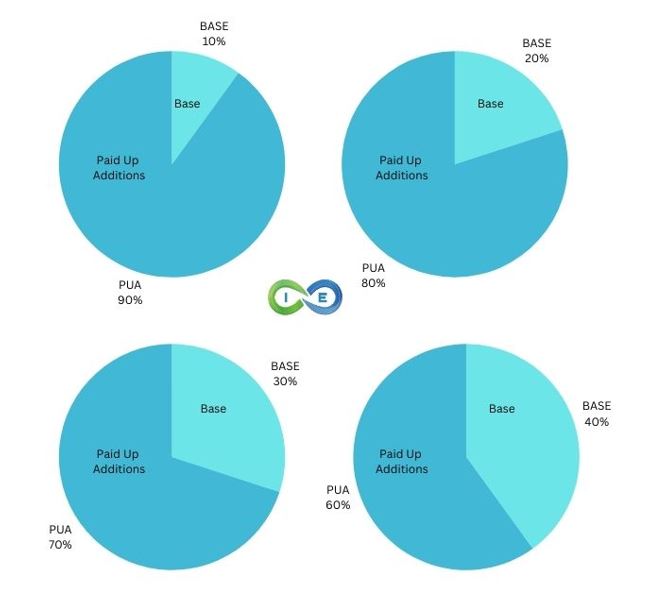

A PUAR permits you to "overfund" your insurance plan right approximately line of it coming to be a Customized Endowment Agreement (MEC). When you use a PUAR, you swiftly boost your money worth (and your survivor benefit), thereby boosting the power of your "bank". Even more, the even more cash money worth you have, the greater your interest and returns repayments from your insurance provider will be.

With the surge of TikTok as an information-sharing platform, monetary advice and methods have actually located an unique means of spreading. One such method that has been making the rounds is the infinite financial concept, or IBC for brief, garnering recommendations from celebrities like rap artist Waka Flocka Fire - Leverage life insurance. Nonetheless, while the approach is presently preferred, its origins trace back to the 1980s when economic expert Nelson Nash introduced it to the globe.

What is Infinite Banking Vs Traditional Banking?

Within these policies, the cash worth expands based on a price established by the insurer. Once a substantial money worth builds up, insurance holders can obtain a money worth funding. These lendings vary from standard ones, with life insurance coverage serving as collateral, indicating one could lose their coverage if loaning excessively without appropriate money value to support the insurance prices.

And while the allure of these plans is obvious, there are innate restrictions and threats, requiring persistent cash worth surveillance. The strategy's authenticity isn't black and white. For high-net-worth individuals or business owners, especially those utilizing approaches like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth can be appealing.

The appeal of infinite banking doesn't negate its challenges: Price: The foundational need, a permanent life insurance coverage plan, is costlier than its term equivalents. Eligibility: Not every person gets approved for whole life insurance policy because of rigorous underwriting processes that can omit those with particular health and wellness or way of life conditions. Complexity and danger: The elaborate nature of IBC, paired with its threats, may deter several, especially when simpler and much less high-risk choices are readily available.

How do I track my growth with Infinite Banking For Retirement?

Allocating around 10% of your monthly income to the plan is simply not feasible for many individuals. Component of what you read below is just a reiteration of what has currently been stated over.

So prior to you obtain into a situation you're not planned for, know the complying with first: Although the principle is typically sold as such, you're not actually taking a loan from on your own. If that held true, you wouldn't need to settle it. Rather, you're borrowing from the insurer and need to repay it with passion.

Some social media messages suggest using money value from whole life insurance to pay down credit rating card debt. When you pay back the loan, a portion of that interest goes to the insurance coverage business.

What are the tax advantages of Bank On Yourself?

For the very first several years, you'll be settling the payment. This makes it extremely challenging for your policy to accumulate worth during this time. Entire life insurance expenses 5 to 15 times a lot more than term insurance policy. Lots of people simply can't afford it. Unless you can manage to pay a couple of to numerous hundred dollars for the next years or even more, IBC won't function for you.

If you need life insurance policy, below are some useful ideas to consider: Consider term life insurance. Make certain to go shopping about for the best price.

What financial goals can I achieve with Self-financing With Life Insurance?

Envision never ever having to fret concerning financial institution loans or high rate of interest prices again. That's the power of limitless financial life insurance policy.

There's no set finance term, and you have the freedom to choose the settlement schedule, which can be as leisurely as repaying the funding at the time of fatality. This adaptability expands to the servicing of the fundings, where you can go with interest-only repayments, maintaining the lending balance level and manageable.

Can anyone benefit from Policy Loans?

Holding cash in an IUL taken care of account being credited rate of interest can frequently be better than holding the cash money on deposit at a bank.: You have actually constantly dreamed of opening your own bakery. You can obtain from your IUL policy to cover the preliminary costs of renting out a space, purchasing tools, and hiring team.

Personal finances can be gotten from typical banks and credit history unions. Borrowing money on a debt card is usually extremely costly with annual percent rates of interest (APR) usually reaching 20% to 30% or even more a year.

Table of Contents

Latest Posts

How To Be Your Own Bank

How Do You Become Your Own Bank

Becoming Your Own Banker

More

Latest Posts

How To Be Your Own Bank

How Do You Become Your Own Bank

Becoming Your Own Banker