All Categories

Featured

Table of Contents

You then get the automobile with cash money. Infinite wealth strategy. The disagreement made in the LIFE180 video is that you never obtain anywhere with a sinking fund. You deplete the fund when you pay cash for the auto and replenish the sinking fund only to the previous level. That is a huge misunderstanding of the sinking fund! The cash in a sinking fund makes interest.

That is how you stay on top of inflation. The sinking fund is always expanding via interest from the conserving account or from your cars and truck repayments to your vehicle sinking fund. It likewise happens to be what limitless banking easily fails to remember for the sinking fund and has outstanding recall when put on their life insurance policy product.

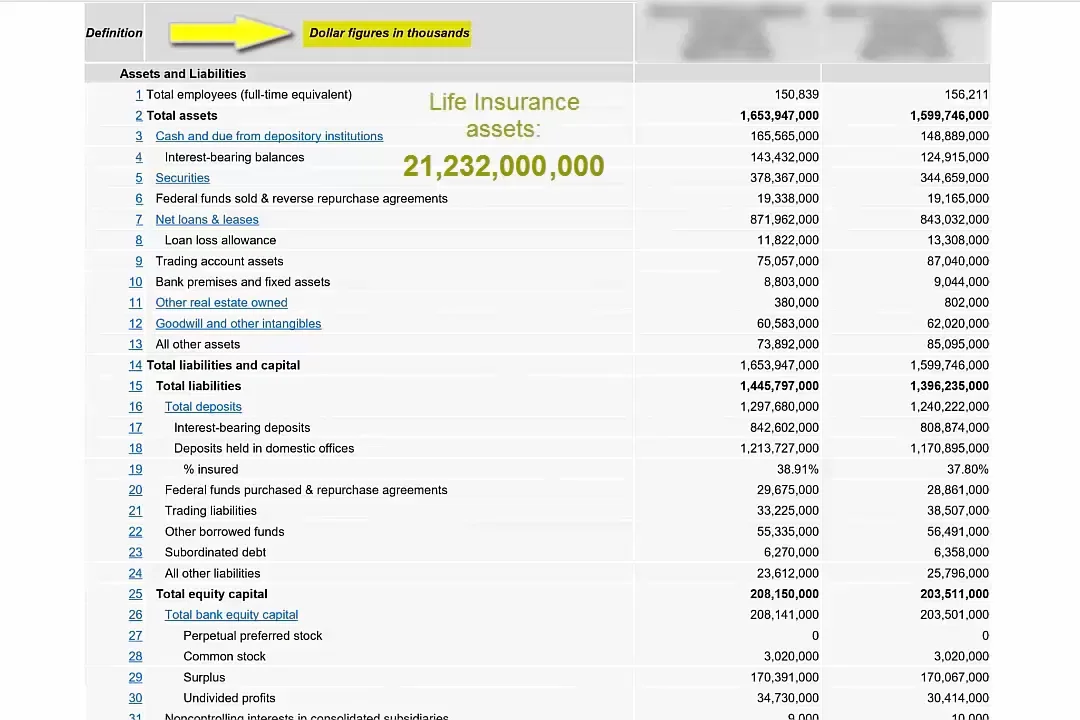

That, we are told, is the rise in our money worth in year two. The genuine boast should be that you added $220,000 to the limitless banking policy and still just have a Cash Value of $207,728, a loss of $12,272 up to this point

What is the long-term impact of Whole Life For Infinite Banking on my financial plan?

You still have a loss no matter what column of the projection you utilize.

Currently we turn to the longer term price of return with unlimited financial. Before we reveal real long-lasting price of return in the entire life policy estimate of a marketer of boundless banking, allow's consider the concept of connecting a lot cash up in what in the video clip is called a savings account.

The only way to transform this into a win is to utilize damaged math. First, review the future worth calculator below - Policy loan strategy. (You can use a variety of other calculators to get the very same results.) After one decade you take care of a little bit a lot more than a 2% yearly price of return.

What resources do I need to succeed with Infinite Wealth Strategy?

The concept is to get you to believe you can earn cash on the cash obtained from your unlimited financial account while all at once collecting a profit on other financial investments with the exact same cash. Which leads us to the next achilles' heel. When you take a funding from your whole life insurance coverage plan what really occurred? The cash value is a legal assurance.

The "appropriately structured whole life plan" bandied about by vendors of boundless financial is truly simply a life insurance company that is had by insurance holders and pays a dividend. The only reason they pay a returns (the passion your money value earns while borrowed out) is because they overcharged you for the life insurance.

Each insurer is different so my example is not a perfect suit to all "properly structured" unlimited banking examples. It works similar to this. When you obtain a finance of "your" cash value you pay passion. THIS IS AN ADDITIONAL FINANCING OF YOUR UNLIMITED BANKING ACCOUNT AND NOT REVEALED IN THE ILLUSTRATION! Think of if they would certainly have added these total up to their sinking fund instance.

What are the tax advantages of Infinite Banking Account Setup?

Also if the insurance policy company credited your cash worth for 100% of the interest you are paying on the lending, you are still not getting a complimentary adventure. Whole life for Infinite Banking. YOU are paying for the rate of interest attributed to your money worth for the quantities lent out! Yes, each insurance policy business entire life policy "properly structured" for infinite banking will certainly differ

When you die, what takes place with your whole life insurance coverage policy? Bear in mind when I mentioned the loan from your cash money value comes from the insurance firms general fund? Well, that is due to the fact that the cash worth belongs to the insurance policy company.

Life insurance firms and insurance policy agents enjoy the principle and have adequate factor to be blind to the fatal defects. In the end there are only a few reasons for making use of irreversible life insurance coverage and boundless banking is not one of them, no issue just how "properly" you structure the plan.

The following approach is a variation of this approach where no debt is needed. Right here is how this technique functions: You will require a home loan and line of credit score.

What are the common mistakes people make with Infinite Banking Vs Traditional Banking?

Your regular home mortgage is now paid down a little bit greater than it would certainly have been. Rather of maintaining greater than a token amount in your checking account to pay bills you will certainly go down the cash right into the LOC. You currently pay no rate of interest because that quantity is no longer borrowed.

If your LOC has a higher rate of interest rate than your home loan this strategy runs right into issues. If your mortgage has a higher price you can still use this strategy as long as the LOC rate of interest rate is similar or lower than your mortgage rate of interest price.

Unlimited financial, as promoted by insurance policy agents, is designed as a huge cost savings account you can borrow from. As we saw above, the insurance coverage company is not the warm, fuzzy entity handing out free money.

If you get rid of the insurance firm and spend the very same monies you will have extra since you do not have middlemen to pay. And the interest rate paid is possibly higher, relying on present rates of interest. With this in mind, Treasury Direct is an excellent device for building riches with your excess funds allocated for savings and no state revenue tax obligations.

What are the benefits of using Wealth Building With Infinite Banking for personal financing?

Below is the magic of infinite financial. When you obtain your own cash you additionally pay on your own an interest rate.

Table of Contents

Latest Posts

How To Be Your Own Bank

How Do You Become Your Own Bank

Becoming Your Own Banker

More

Latest Posts

How To Be Your Own Bank

How Do You Become Your Own Bank

Becoming Your Own Banker